Email Marketing for Financial Services: Leveraging UseINBOX’s Comprehensive Tools

Table Of Contents

In an increasingly digital landscape, financial services are no longer confined to face-to-face interactions or traditional communication channels. From investment advisory firms to insurance companies and banks, the financial sector is undergoing a profound transformation. Clients now expect seamless, personalised communication that addresses their specific needs, interests, and financial goals. This is where email marketing emerges as a game-changer. Email marketing offers financial institutions the ability to maintain ongoing communication, build lasting relationships, and deliver targeted content directly to clients’ inboxes.

At the heart of this transformation is the shift from mass marketing to personalised, data-driven communication. Financial institutions, from the largest banks to small advisory firms, must adopt email marketing strategies to stay competitive and deliver value to their clients. Yet, with the complexity of financial regulations and the need to maintain client trust, email marketing in financial services requires precision, security, and compliance.

This is where UseINBOX provides the perfect solution. As a leading provider of email marketing tools, UseINBOX offers a suite of services tailored to meet the specific needs of financial institutions. Whether it's sending bulk marketing newsletters, transactional emails, or engaging cold email campaigns, UseINBOX provides the necessary infrastructure to ensure seamless communication.

In this in-depth guide, we will explore the unique benefits of email marketing for financial services, discuss the key strategies for effective email campaigns, and examine how UseINBOX's suite of tools —UseINBOX, Notify, INBOXForms, LandingPages, INBOXTouch, and INBOXCold— can help institutions streamline their efforts and achieve measurable success.

Understanding Email Marketing in Financial Services

Definition and Scope

Email marketing, at its core, refers to the strategic use of email to promote products, services, or updates, and to maintain client engagement. In the financial services sector, email marketing serves as a vital communication tool that spans a wide range of activities, including promoting banking services, offering investment advice, and sending regulatory updates. It allows financial institutions to reach clients directly, offering a personalized and secure communication channel that strengthens trust and loyalty.

Financial institutions often employ two primary types of email communication: marketing emails and transactional emails. Marketing emails are designed to engage clients by offering product updates, insights, and promotions. For example, an email could announce a new investment opportunity, provide tips on saving for retirement, or promote an insurance product. On the other hand, transactional emails focus on providing essential information, such as transaction confirmations, account statements, or regulatory notifications. Both types of emails play a crucial role in maintaining continuous, effective communication with clients.

UseINBOX offers a wide array of tools that address these needs, allowing financial institutions to manage both marketing and transactional emails effortlessly. UseINBOX provides financial institutions with the ability to send bulk marketing newsletters that promote products and services, keeping clients informed about the latest offerings. At the same time, Notify allows institutions to send transactional emails through SMTP and API integration, ensuring that essential notifications are delivered in a timely and secure manner.

Email marketing in financial services also serves as an essential tool for compliance. Regulatory requirements such as GDPR, CASL, and CAN-SPAM mandate strict guidelines on how financial institutions communicate with their clients. From opt-in consent to providing unsubscribe links, these regulations require financial institutions to ensure that their email campaigns adhere to the highest standards of privacy and security. UseINBOX simplifies this process by providing tools that automatically incorporate compliance features, such as unsubscribe links and list management functionalities that keep client data secure.

Tip: Financial institutions can strengthen client trust by using personalized email campaigns for both marketing and transactional communications while ensuring regulatory compliance.

By leveraging UseINBOX’s suite of tools, financial institutions can streamline both their marketing and transactional email efforts while ensuring compliance with industry regulations.

Integration with Financial Products

One of the significant advantages of email marketing is its ability to seamlessly integrate with a financial institution’s portfolio of products and services. Whether promoting a new financial product, offering personalized financial advice, or providing updates on existing services, email marketing allows institutions to deliver timely, relevant content to clients.

For example, a wealth advisory firm may use UseINBOX to create a personalized email campaign that introduces a new investment portfolio. By leveraging the segmentation features within the platform, the firm can target clients based on their risk tolerance, age, or financial goals, ensuring that each client receives the most relevant information. This level of personalization enhances client engagement and increases the likelihood of conversion.

Similarly, banks can use UseINBOX to promote new banking products, such as savings accounts, loans, or credit cards. By creating engaging newsletters that highlight the benefits of these products, banks can increase awareness and drive more applications. Financial institutions can also create product-specific email campaigns that offer educational content, helping clients make informed decisions about their financial future.

INBOXForms is another valuable tool that helps financial institutions capture client data and convert interest into action. By embedding custom subscription forms on their websites, institutions can encourage visitors to sign up for newsletters, receive product updates, or request personalized financial advice. INBOXForms allows financial institutions to gather critical information such as client preferences, contact details, and financial interests, enabling more targeted email marketing campaigns.

For financial institutions looking to drive engagement through specific campaigns, LandingPages provides the ability to create customized landing pages that align with the content of their email marketing efforts. For example, if a financial institution is offering a limited-time promotion on a new investment product, the email campaign can direct recipients to a dedicated landing page created using LandingPages. This landing page can provide detailed information about the product, offer an easy sign-up process, and drive conversions through a clear call-to-action (CTA).

Tip: Use personalized email campaigns to promote financial products based on client preferences, boosting engagement and conversion rates.

In addition to driving engagement with existing clients, financial institutions can expand their reach using INBOXCold, which allows for cold email campaigns targeted at potential prospects. Whether promoting new products or offering introductory financial advice, INBOXCold enables institutions to reach new audiences, generate leads, and expand their client base. INBOXCold ensures that all cold email campaigns comply with email marketing regulations, protecting the institution’s reputation and ensuring that outreach efforts are legally compliant.

Regulatory Compliance

The financial services industry is one of the most regulated sectors in the world. As such, financial institutions must navigate a complex regulatory environment when conducting email marketing campaigns. Compliance with regulations such as ;

- GDPR (General Data Protection Regulation),

- CASL (Canadian Anti-Spam Law),

- CAN-SPAM (Controlling the Assault of Non-Solicited Pornography And Marketing Act) is critical to avoiding hefty fines and maintaining client trust.

GDPR, in particular, has introduced stringent rules governing how companies collect, store, and use personal data. Financial institutions must ensure that their email marketing practices comply with these rules, which include obtaining explicit consent from clients before sending marketing emails, providing easy opt-out options, and ensuring data is securely stored.

UseINBOX simplifies the compliance process by incorporating tools that automatically enforce regulatory requirements. For example, all emails sent through UseINBOX and Notify include unsubscribe links, ensuring that clients can easily opt out of future communications. INBOXForms also offers double opt-in functionality, which requires users to confirm their consent to receive emails, thereby protecting financial institutions from legal liabilities associated with unsolicited emails.

The platform also supports IP blacklisting and domain verification, helping financial institutions maintain a positive sender reputation and avoid being marked as spam. By using UseINBOX’s domain authentication features, institutions can ensure that their emails are delivered securely, enhancing client trust.

For institutions conducting cold email campaigns using INBOXCold, regulatory compliance is particularly important. Cold emails are often subject to stricter rules regarding unsolicited communications, so it is crucial that all campaigns are compliant with relevant laws. INBOXCold helps financial institutions manage cold email campaigns within the legal framework, providing features that ensure all emails are properly consented to and delivered in a compliant manner.

Benefits of Email Marketing for Financial Advisors

Client Retention

Client retention is a critical metric for financial advisors, as maintaining strong relationships with clients ensures a steady stream of business. In an industry built on trust and long-term relationships, email marketing provides financial advisors with a cost-effective method to stay top-of-mind with clients, deliver valuable insights, and provide personalized financial advice.

UseINBOX offers financial advisors a robust platform for creating engaging newsletters that keep clients informed and engaged. Regular communication through email newsletters allows advisors to provide clients with updates on market trends, portfolio performance, and new investment opportunities. These newsletters can also include educational content, such as how-to guides on managing retirement accounts or tips for saving on taxes.

Financial advisors can use INBOXForms to invite clients to subscribe to specific types of newsletters, such as monthly market updates or product-specific announcements. This segmentation allows advisors to tailor their email campaigns to match clients’ interests, ensuring that each client receives relevant and timely information.

For example, a financial advisor may create a newsletter for clients nearing retirement that provides in-depth advice on maximizing retirement savings, managing 401(k) accounts, and navigating the complexities of Social Security. By providing personalized content that aligns with clients' life stages, advisors can build stronger relationships and improve retention rates.

Automated workflows within UseINBOX also allow financial advisors to create drip campaigns that nurture client relationships over time. For instance, an advisor might set up an automated email sequence that educates clients about setting up a trust or managing estate planning. By automating these processes through UseINBOX, financial advisors can maintain consistent communication with their clients without requiring constant manual effort. This not only improves efficiency but also ensures that clients receive timely, relevant content that reinforces the advisor-client relationship.

Another effective strategy for client retention is using Notify to send transactional emails that keep clients informed about their accounts and transactions. Financial advisors can use Notify to send personalized account summaries, transaction confirmations, or portfolio performance reports directly to their clients. These transactional emails ensure that clients are always informed about their financial status, enhancing transparency and trust.

Moreover, for financial advisors who frequently network and meet prospective clients at events, INBOXTouch offers a seamless way to follow up. INBOXTouch, which functions as a digital NFC business card, allows advisors to exchange contact information with potential clients during networking events. The captured information can then be synced with the email marketing platform, enabling financial advisors to immediately follow up with personalized emails or even invite new contacts to subscribe to newsletters via INBOXForms. This integration ensures that potential leads are quickly nurtured and transformed into long-term clients.

Lead Generation

Lead generation is a fundamental aspect of business growth for financial advisors, and email marketing serves as one of the most efficient ways to capture, nurture, and convert leads. INBOXForms makes this process incredibly straightforward by enabling financial advisors to create custom subscription forms that can be embedded on websites, landing pages, or shared across social media platforms.

These forms serve as a direct channel for potential clients to express interest in specific financial services, such as retirement planning, tax advice, or investment management. Once a prospect fills out a form, their information is automatically added to the advisor’s email marketing database, making it easy to follow up with personalized content.

Tip: Use personalized email campaigns to promote financial products based on client preferences, boosting engagement and conversion rates.

Once prospects have subscribed, advisors can use UseINBOX to create a nurturing campaign that delivers a series of educational emails designed to build trust and demonstrate the advisor’s expertise. This process moves leads further down the funnel and encourages them to book consultations or sign up for services.

Furthermore, the ability to create custom landing pages with LandingPages enhances the lead generation process by directing potential clients to dedicated web pages that align with specific campaigns. For example, if a financial advisor is promoting a new wealth management service, they can create a landing page that highlights the service’s benefits and includes a subscription form from INBOXForms to capture leads. The landing page can be shared via email campaigns, social media, or even during webinars, driving traffic to a conversion-optimized page that encourages prospects to take action.

One of the most powerful tools for expanding lead generation is INBOXCold, UseINBOX's cold email platform designed for reaching out to prospects who have not yet engaged with the financial institution. Cold emailing, when done correctly and compliantly, can be a highly effective method for financial advisors to introduce themselves to new prospects, promote services, and generate new leads. INBOXCold enables financial advisors to send personalized cold emails at scale, allowing for targeted outreach that increases the likelihood of generating new business. By integrating cold emails into their broader email marketing strategy, financial advisors can consistently reach out to new audiences and grow their client base.

Cost-Effectiveness

One of the most compelling benefits of email marketing, particularly for financial advisors and smaller institutions, is its cost-effectiveness. Compared to traditional advertising channels—such as print ads, billboards, or television commercials—email marketing is far more affordable, yet it offers a higher return on investment (ROI). Financial institutions can reach thousands of clients through email campaigns with minimal costs involved, making it one of the most efficient ways to communicate with clients.

UseINBOX allows financial institutions to run scalable email campaigns that can be easily adapted to different budget sizes. For small to mid-sized financial advisory firms, this scalability is essential, as it ensures that email marketing remains accessible even if the firm is operating with a modest marketing budget. Advisors can craft and send professional-grade email campaigns without the need for extensive design or technical expertise, thanks to UseINBOX’s drag-and-drop editor.

Additionally, transactional emails sent through Notify allow financial institutions to deliver critical information (such as account updates or payment confirmations) without incurring extra costs typically associated with more traditional communication methods like phone calls or mailed statements. By automating these notifications, financial institutions can further reduce overhead while maintaining consistent and reliable communication with their clients.

Tip: For smaller financial institutions, email marketing offers a cost-effective way to reach a targeted audience, maximizing ROI without the high costs of traditional advertising.

Furthermore, compared to digital marketing channels such as social media ads or pay-per-click (PPC) campaigns, email marketing offers a more direct and cost-efficient method of communication. While social media and PPC can be expensive, especially when targeting niche audiences, email marketing allows financial institutions to communicate with clients who have already expressed interest in their services by subscribing to their email lists. This targeted approach increases engagement and conversion rates, ultimately delivering a higher ROI.

Key Strategies for Effective Email Campaigns

Personalization and Segmentation

One of the most powerful strategies for financial institutions to enhance client engagement through email marketing is personalization. In the financial services industry, where clients’ needs and preferences vary significantly based on their financial goals, it is crucial to deliver content that is tailored to each client’s unique situation. UseINBOX provides financial institutions with advanced personalization tools that allow for deep customization of email content based on individual client profiles.

For example, a financial advisor may segment clients based on their financial goals, age, or income level. Younger clients may be more interested in saving for a home or managing student loans, while older clients may be focused on retirement planning or wealth management. By using the segmentation features in UseINBOX, advisors can create distinct groups based on these factors and deliver highly targeted content that speaks directly to each group’s specific needs.

Segmentation not only improves engagement but also boosts conversion rates by ensuring that clients receive content that is both relevant and timely. UseINBOX’s segmentation capabilities allow financial institutions to divide their email lists into various categories, such as income brackets, client behavior, financial goals, or even recent interactions with the institution’s website or customer service team.

For instance, clients who have recently signed up for a new service may receive follow-up emails that offer additional resources or suggestions for complementary products. Clients who are nearing retirement age may receive educational content on tax planning or estate management. This behavioral segmentation ensures that each client receives relevant content at the right time, increasing the likelihood of further engagement.

The ability to segment clients based on real-time data—such as email opens, click-throughs, and website activity—also allows for more dynamic, responsive marketing campaigns. Financial institutions can use UseINBOX to automatically adjust campaign content based on a client’s interactions. For example, if a client clicks on a link within an email about retirement planning, they may be moved into a segment that receives more detailed information on retirement accounts or tax-advantaged investment strategies.

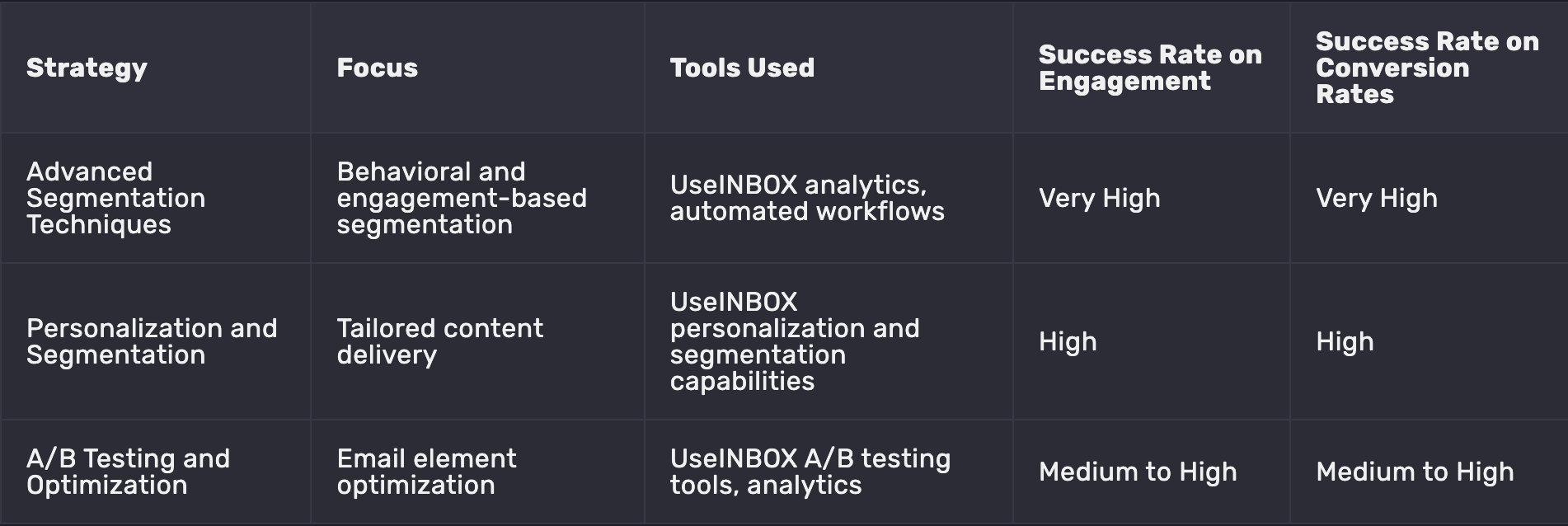

Advanced Segmentation Techniques

In addition to basic segmentation based on demographic factors, financial institutions can benefit from employing advanced segmentation techniques that take client behavior, engagement history, and financial interests into account. With UseINBOX’s analytics tools, financial institutions can deploy behavioral segmentation, tracking client interactions with previous emails, landing pages, and website content to create more personalized and effective campaigns.

For instance, a financial institution may notice that clients who have clicked on an email link about investment opportunities are more likely to open future emails related to wealth management. These clients can be added to a special high-engagement segment and receive additional content designed to nurture their interest in long-term investment solutions. Similarly, clients who have shown interest in saving for college may be targeted with educational content on 529 plans or tax-advantaged savings accounts.

Tip: Boost engagement by using segmentation to send personalized financial content based on client goals, behavior, and real-time interactions.

Trigger-based emails are another form of advanced segmentation that can help financial institutions deliver personalized content at the right moment. By setting up automated workflows within UseINBOX, financial institutions can trigger emails based on specific client actions, such as visiting a certain webpage, making a transaction, or reaching a financial milestone. For example, if a client’s account balance reaches a specific threshold, the financial institution could automatically send a personalized email offering suggestions for high-yield savings accounts or investment options.

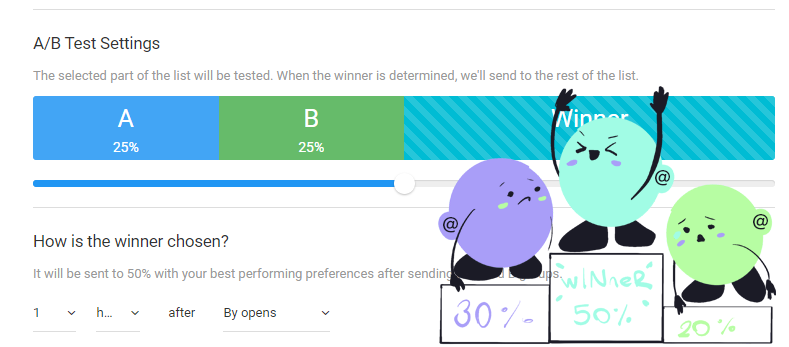

These advanced segmentation strategies allow financial institutions to create more relevant and timely campaigns, improving engagement and conversion rates across their client base. Financial institutions can also use A/B testing within UseINBOX to refine their segmentation strategies. By testing different subject lines, email layouts, and content formats, institutions can determine what resonates best with each client segment and optimize future campaigns accordingly.

A/B Testing and Optimization

To ensure that email campaigns achieve the best possible results, financial institutions must continuously test and optimize their email content. A/B testing is a key strategy that allows institutions to test different elements of their emails, such as subject lines, content, and CTAs, to determine what drives the highest engagement rates. UseINBOX includes built-in A/B testing tools that make it easy to compare different versions of an email and identify the most effective approach.

To ensure that email campaigns achieve the best possible results, financial institutions must continuously test and optimize their email content. A/B testing is a key strategy that allows institutions to test different elements of their emails, such as subject lines, content, and CTAs, to determine what drives the highest engagement rates. UseINBOX includes built-in A/B testing tools that make it easy to compare different versions of an email and identify the most effective approach.

For example, a financial institution might test two different subject lines for an email promoting a new investment product. One subject line might focus on urgency (“Act Now: Limited-Time Investment Opportunity”), while the other takes a more informative approach (“Discover Your Next Investment Opportunity”). By testing both subject lines and measuring open rates, the institution can determine which approach resonates better with its audience.

A/B testing can also be applied to email content. Financial institutions can test different layouts, images, or message lengths to see what drives higher click-through rates or conversions. For instance, a financial advisor might experiment with different types of content in their emails, such as long-form educational content versus short, actionable tips. One version of the email could provide in-depth explanations of investment strategies, while the other might focus on quick, digestible advice with clear CTAs encouraging clients to schedule a consultation or download a guide. By testing both approaches, the advisor can identify which format leads to more client engagement.

A/B testing is not limited to just content or subject lines—it can also be applied to design elements. For instance, financial institutions can test different CTA button placements, colors, or even email layouts to see what drives more interactions. Some clients may respond better to a simple, clean design with minimal text, while others might prefer detailed, informative emails with multiple links. By leveraging UseINBOX’s A/B testing capabilities, financial institutions can continuously refine their emails for maximum impact.

Tip: Use A/B testing to optimize subject lines, content, and design, ensuring your financial email campaigns drive maximum engagement and conversions.

Optimization goes hand-in-hand with testing. UseINBOX’s analytics tools allow financial institutions to track key performance metrics such as open rates, click-through rates, and conversion rates. By reviewing these metrics after A/B testing, financial institutions can make data-driven decisions to optimize future email campaigns. If certain segments of clients consistently engage more with particular content or designs, those elements can be incorporated into future campaigns to drive further success.

Tools and Technologies for Financial Email Marketing

UseINBOX’s Comprehensive Toolset

Email marketing success in the financial services sector hinges on having the right tools in place to execute effective campaigns. UseINBOX provides a comprehensive suite of products specifically designed to help financial institutions create, send, and optimize email campaigns, while also ensuring compliance and security.

Let’s explore each of UseINBOX’s key tools and how they can benefit financial institutions:

- UseINBOX: This core tool is perfect for sending bulk marketing newsletters. Financial institutions can design professional-grade newsletters using UseINBOX’s drag-and-drop editor, which makes creating visually appealing emails easy and efficient, even for teams without technical or design expertise. These newsletters can keep clients informed about new products, market trends, or investment opportunities.

- Notify: Financial institutions can leverage Notify to send transactional emails via SMTP and API. Transactional emails are critical in the financial sector, as they keep clients informed about important account activity, such as transaction confirmations, payment updates, or account statements. With Notify, these emails can be personalized and delivered securely, ensuring that clients receive timely notifications.

- INBOXForms: Lead generation is simplified with INBOXForms, which enables financial institutions to create custom subscription forms that capture contact information from potential clients. These forms can be embedded on websites, shared through social media, or included in email campaigns, helping institutions build their mailing lists and drive new business.

- LandingPages: UseINBOX LandingPages provides an easy way to create customized landing pages for targeted email campaigns. These landing pages can be used to promote specific financial products, such as investment plans or insurance policies. By creating dedicated landing pages with clear CTAs, financial institutions can increase conversions by directing clients to the information they need in a focused, user-friendly environment.

- INBOXTouch: For financial advisors who frequently attend networking events or meet clients in person, INBOXTouch offers a modern solution for exchanging contact information. This integrated NFC business card allows advisors to share their contact details with prospects seamlessly. Once exchanged, this information can be synced with UseINBOX, enabling advisors to follow up with personalized email campaigns, ensuring that new leads are nurtured effectively.

- INBOXCold: Cold outreach is often an integral part of financial institutions’ marketing strategies, particularly when targeting new prospects. INBOXCold provides an integrated cold email platform that allows financial institutions to reach out to potential clients who may not yet be familiar with their services. By personalizing cold emails and using compliant outreach techniques, INBOXCold enables institutions to build new relationships and expand their client base.

Each of these tools works in tandem to provide a comprehensive email marketing solution for financial institutions. From initial lead generation and email design to transactional email delivery and cold outreach, UseINBOX equips financial institutions with the capabilities they need to run effective, compliant, and engaging email campaigns.

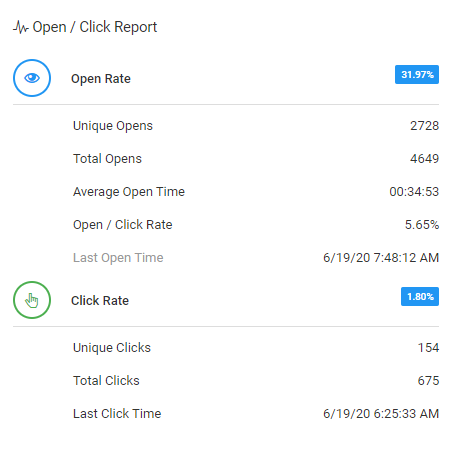

Analytics and Feedback: Measuring Success

Tracking the success of email marketing campaigns is essential for continuous improvement. Financial institutions need access to detailed analytics like we offer that allow them to measure performance, identify areas for improvement, and optimize future campaigns.

UseINBOX offers powerful analytics tools that provide insights into key performance indicators (KPIs) such as:

- Open rates: The percentage of recipients who opened the email.

- Click-through rates (CTR): The percentage of recipients who clicked on a link within the email.

- Bounce rates: The percentage of emails that could not be delivered to recipients.

- Conversion rates: The percentage of recipients who took the desired action after receiving the email, such as signing up for a service or making a transaction.

By analyzing these metrics, financial institutions can determine the effectiveness of their email campaigns. For example, a high open rate but low click-through rate may indicate that the subject line is compelling, but the email content or CTA needs improvement. Conversely, if emails are consistently landing in recipients’ spam folders (resulting in high bounce rates), institutions may need to revisit their domain authentication or list management practices.

The conversion rate is perhaps the most critical metric for financial institutions, as it directly correlates to the campaign’s success in driving business outcomes. For example, if a bank is running an email campaign to promote a new savings account, the conversion rate would reflect how many recipients signed up for the account after receiving the email. By tracking conversion rates, financial institutions can assess whether their email campaigns are effectively generating new business or retaining existing clients.

Tip: Track key metrics like open rates and conversion rates to continuously optimize your financial email campaigns for better engagement and business outcomes.

UseINBOX’s analytics platform provides real-time feedback, enabling financial institutions to make adjustments mid-campaign if necessary. For instance, if a particular email in a sequence is underperforming, the institution can modify the content or subject line before sending it to the remaining audience, ensuring that the campaign remains optimized throughout its duration.

In addition to analyzing individual campaign performance, financial institutions can track long-term trends in client engagement. By reviewing data over time, institutions can identify patterns, such as which types of content perform best with certain segments or when clients are most likely to engage with emails. This data can be used to refine email marketing strategies, ensuring that future campaigns are even more effective.

Challenges and Solutions in Financial Email Marketing

Deliverability and Engagement

One of the primary challenges in email marketing, particularly for financial institutions with large client bases, is ensuring that emails are successfully delivered and engage recipients effectively. Email deliverability refers to the ability of emails to reach the inboxes of recipients without being flagged as spam or blocked by filters. Low deliverability can significantly reduce the effectiveness of even the most well-designed email campaigns.

UseINBOX offers several features that help financial institutions address deliverability challenges. One key feature is domain verification and SPF/DKIM authentication, which ensure that the sender’s identity is authenticated and that the email is not marked as suspicious by email service providers. By verifying the sending domain, UseINBOX helps institutions improve their sender reputation and ensures that emails are delivered to the inbox rather than the spam folder.

Maintaining a healthy email list is another critical factor in ensuring high deliverability. Financial institutions can use UseINBOX’s list management tools to automatically clean their mailing lists by removing inactive or invalid email addresses. This practice, known as list hygiene, ensures that emails are sent only to active, engaged recipients, reducing the likelihood of bounce rates and improving overall deliverability.

Another significant challenge is client engagement. Financial institutions often compete for attention in crowded inboxes, especially when clients receive numerous emails from various service providers. To overcome this, financial institutions can use interactive elements in their email campaigns, such as clickable content, videos, or interactive polls. These features encourage clients to engage with the email content, increasing the chances that they will take the desired action, whether it’s signing up for a service or scheduling a consultation.

Tip:Improve email deliverability by using SPF/DKIM authentication and maintaining a clean email list, while boosting engagement with interactive content like videos or quizzes.

With UseINBOX, financial institutions can create interactive emails that stand out and capture the attention of their clients. For example, embedding a video explainer on a new investment product or including a quiz that helps clients determine their financial goals can significantly improve engagement.

Integrating with Other Marketing Channels

While email marketing is an incredibly effective channel on its own, it works even better when integrated with other digital marketing channels. Financial institutions can create a cohesive marketing strategy by ensuring that their email campaigns align with their social media efforts, content marketing, and even paid advertising.

For example, financial institutions can use email campaigns to promote blog posts or educational resources from their website. If the institution regularly publishes articles on retirement planning, tax strategies, or investment tips, these pieces can be highlighted in email newsletters, driving traffic to the institution’s blog or resource center. By linking email content with longer-form resources, financial institutions can position themselves as thought leaders and build trust with their clients.

In addition to content marketing, financial institutions can use email campaigns to promote webinars or virtual events. Webinars are an excellent way for financial advisors to engage with clients in real time, providing valuable insights on market trends, financial planning, or investment opportunities. By sending personalized email invitations to specific client segments, institutions can increase attendance and encourage clients to participate in these events.

Trends and the Future of Email Marketing in Financial Services

Emerging Trends

As technology continues to evolve, so does the potential for email marketing to become even more personalized, data-driven, and interactive. One of the most significant trends shaping the future of email marketing in financial services is the increased use of AI and machine learning to enhance personalization and predict client behavior.

Artificial Intelligence (AI) allows financial institutions to analyze vast amounts of client data to determine patterns and predict future behavior. For example, AI can be used to send emails at the optimal time when a client is most likely to open them, based on their historical email interaction data. AI can also automate the process of content recommendations, suggesting relevant products or services to clients based on their preferences, financial goals, or past interactions with the institution’s emails.

By integrating AI into its platform, UseINBOX can help financial institutions make data-driven decisions about their email campaigns. For example, financial institutions can use AI-powered segmentation tools to create highly targeted email lists based on predicted client behavior. This approach ensures that clients receive the most relevant content, increasing engagement rates and boosting conversions.

Machine learning also plays a role in personalization by allowing email marketing platforms to continuously learn from past campaigns and improve over time. By analyzing which types of content, subject lines, or CTAs perform best, machine learning algorithms can help financial institutions optimize their campaigns for higher open rates, click-through rates, and conversions.

Another emerging trend in email marketing is the integration of interactive content within emails. Financial institutions are beginning to embed interactive elements, such as surveys, polls, calculators, and quizzes, directly into their emails. For instance, a bank might include a mortgage calculator within an email to help clients determine how much they can afford to borrow. These interactive elements not only engage clients but also provide valuable insights into their preferences and financial needs.

With UseINBOX, financial institutions can take advantage of these trends by incorporating interactive elements into their email campaigns. For example, a financial advisor could send an email that includes a risk tolerance quiz, helping clients identify their investment risk preferences and suggesting appropriate financial products based on the results.

Future Outlook

Looking ahead, the future of email marketing in financial services is bright, as new technologies and strategies continue to evolve. The personalization of email campaigns is expected to become even more sophisticated, with AI and machine learning playing a central role in delivering hyper-targeted content that resonates with individual clients. Financial institutions that embrace these technologies will be better positioned to deliver timely, relevant, and personalized emails that strengthen client relationships and drive growth.

The future of email automation is also poised for significant advancements. Automated email sequences, triggered by specific client actions or milestones, will become more commonplace, enabling financial institutions to engage clients in real time without manual intervention. As clients move through different stages of their financial journey, from saving for college to planning for retirement, automated emails can be tailored to offer the most relevant advice, products, and services at each stage.

Data privacy and regulatory compliance will remain top priorities for financial institutions as email marketing continues to evolve. Regulations like GDPR and CASL are expected to expand, introducing stricter guidelines on how financial institutions collect, store, and use client data for email marketing. Financial institutions will need to stay agile and adapt their practices to ensure that their email campaigns are compliant with the latest laws. Platforms like UseINBOX will continue to provide the necessary tools to help institutions maintain compliance while delivering secure and reliable email communications.

Additionally, interactive emails are set to become a standard feature in financial email marketing campaigns. As clients increasingly expect more engaging and immersive digital experiences, financial institutions will need to incorporate dynamic content and interactive elements into their emails to capture attention and drive action. Whether it’s embedding a video that explains a new investment product or including a live poll that gathers client feedback, interactive emails will play a key role in shaping the future of client engagement.

Finally, the integration of email marketing with other digital marketing channels will continue to deepen. Financial institutions will increasingly focus on creating omnichannel marketing strategies that combine the strengths of email marketing with social media, content marketing, webinars, and even chatbots. This integrated approach will ensure that clients receive consistent messaging across all touchpoints, improving the overall client experience and reinforcing brand loyalty.

As financial institutions look to the future, UseINBOX will remain a valuable partner in helping them navigate the evolving landscape of email marketing. By staying ahead of the latest trends and continuously adapting its platform to meet the needs of the financial sector, UseINBOX will empower institutions to leverage email marketing as a core component of their digital strategy.

Conclusion

Email marketing has become an indispensable tool for financial institutions seeking to enhance client communication, drive engagement, and build lasting relationships. With the ability to deliver personalized, secure, and compliant email campaigns, financial institutions can stay connected with their clients and deliver value at every stage of the client journey.

The comprehensive suite of tools offered by UseINBOX—including UseINBOX, Notify, INBOXForms, LandingPages, INBOXTouch, and INBOXCold—provides financial institutions with the capabilities they need to create, send, and optimize effective email campaigns. From promoting new products to managing transactional emails and generating new leads, UseINBOX offers a complete solution for all of an institution’s email marketing needs.

As email marketing continues to evolve, financial institutions that embrace new technologies such as AI, machine learning, and interactive content will be better positioned to meet their clients' changing expectations. By staying agile, compliant, and data-driven, financial institutions can leverage email marketing to achieve measurable success and stay ahead in a competitive landscape.

With UseINBOX as a partner, financial institutions can confidently execute their email marketing strategies, ensuring that their communications are engaging, compliant, and aligned with their business goals. Whether reaching out to new prospects or nurturing long-standing client relationships, UseINBOX provides the tools and insights necessary to make every email campaign a success.